WeWork did not typically choose the most prestigious prime locations for its workspaces. But they were downtown locations with good transportation options right next door, and probably not the cheapest.

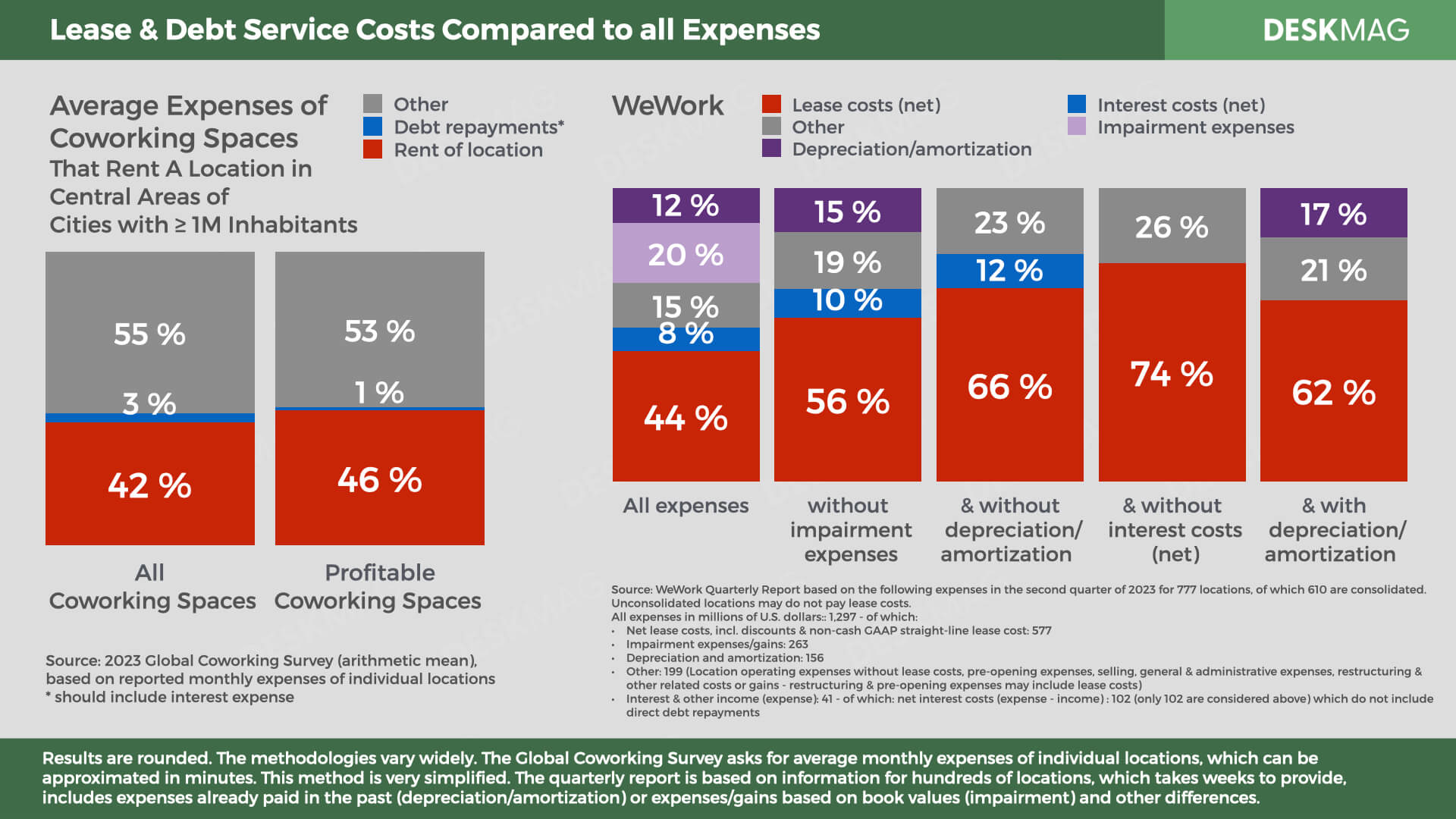

According to the Global Coworking Survey, profitable coworking spaces in central city locations spent about 46% of their total expenses on real estate rent. In its most recent quarterly report, WeWork reported a similar ratio.

Comparison of rental costs between WeWork and coworking spaces in the Global Coworking Survey

However, these are relative values. The unusually high-interest payments and value adjustments push down the relative rental payments at WeWork.

Without these two items, location rents would be over 60% of all expenses, which is probably well above the industry average, even for better locations. WeWork does not even rent all of its locations. A smaller number were operated under management contracts with the property owners.

WeWork may have overpaid for rent compared to the industry

High rents are a legacy of the low-interest-rate era and WeWork's growth strategy. On the one hand, real estate values generally rose sharply before the pandemic. And office buildings in most major cities were very well occupied. A community was hardly necessary for a successful sale. Even porta-potties could easily have been rented out as private offices at high prices if it had been legal.

On the other hand, with investors behind it, WeWork was able to buy into the office market at lease prices that other competitors were unable or unwilling to pay.

Along with WeWork's unfriendly marketing efforts, this was another reason why many coworking spaces feared WeWork's entry into their own markets.

By many accounts, however, WeWork was extremely popular with landlords. That love may have faded for many of them. But it is not because of the business models of coworking spaces.

Different and more flexible workspaces are needed in the post-pandemic world of work

During and after the pandemic, the value of many office properties plummeted. In many regions, there is much less demand for traditional corporate campuses. This is especially true for companies whose employees commute long distances from their spacious suburban homes.

This is not necessarily a bad thing for coworking spaces as they can react more quickly to changing conditions. People still need to work, and not all the time from home. However, for a profitable business model, property owners' prices must also adapt to the new reality.

So far, the lost value has often been borne by the tenants, not the owners.

Many property owners are still benefiting from long-term leases at pre-pandemic prices. Their tenants, including but not limited to coworking spaces, have had to pay for the loss in value to date. With the Chapter 11 filing, WeWork can now terminate long-term leases in previously unattractive locations or negotiate new market rates.

In one of its first post-bankruptcy announcements, WeWork asked the court to terminate contracts for 40 locations in NYC alone! Here's a longer list.

Rather than actual closures, however, such announcements could also set the stage for negotiations that lead to lower rents for WeWork at its current locations - at least for those still in operation. WeWork said most of the exits would affect buildings that are already "largely non-operational."

In a member announcement, WeWork also stated, "we intend to keep our presence in the vast majority of markets". With too few locations, the WeWork model would also make less sense.

Realistic rents would be a game-changer

If WeWork could get significantly more competitive terms without having to make new investments in these locations, it would be a game changer for a profitable business model.

That is, assuming landlords cannot find more attractive alternatives. In cities like New York City or San Francisco, where there is an oversupply of office space, this is currently doubtful. At least if the buildings cannot be quickly and cost-effectively converted into apartments.

Other coworking spaces could also benefit from this development. Assuming realistic price adjustments, they could take over some older but well-equipped coworking locations for a more competitive lease when WeWork is no longer an option for landlords.

In the face of an overdue market correction, landlords may also lower rents for other coworking spaces before more bankruptcies create an even harsher reality. If the real estate owners have owned their office properties for a long time, they have made high profits in the past. The fat cushions they could build up should give them some comfort in the face of current developments.

If the bankruptcy court agrees, WeWork can use Chapter 11 to reduce expenses to a level that should theoretically allow for a profitable business model. However, this will only work if the bankruptcy does not reduce revenues by the same amount. So, let's look at revenues. So far, they are in much better shape than expenses.