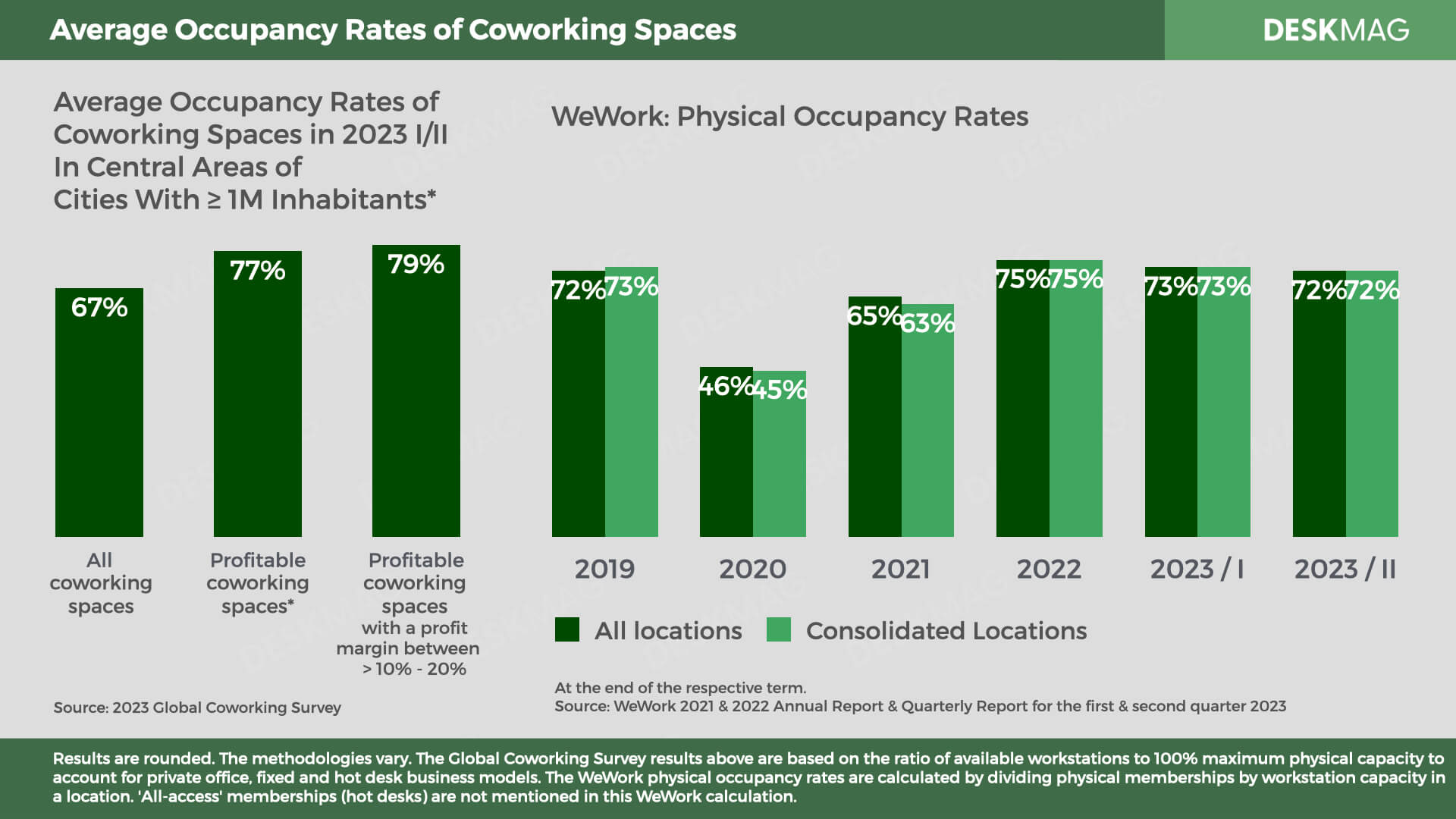

In June 2023, WeWork reported an occupancy rate of 72% for its locations. It was at the same level at the end of 2019. On that basis, the company has largely recovered from the pandemic disruptions. Even by industry standards, this is only slightly below the average for profitable coworking spaces in major cities.

It remains to be seen whether an insolvency would reduce this occupancy rate. There has been speculation about this for months, but the fear of a closed office has not yet translated into a drastic drop in demand.

Prior to the bankruptcy, WeWork was able to offer most customers an alternative to its closed locations because they were mostly located in cities with plenty of other locations. Closing unattractive locations is likely to increase occupancy rates, provided that the attractive locations can be maintained at lower rents.

Occupancy rates do not tell us much about revenue. However, in its most recent quarterly report, WeWork reported revenue of approximately $500 per month per "physical member" (ARPM). This refers to members who work at regular WeWork locations with a permanent desk or assigned office. The vast majority of WeWork members work under this model.

Based on the number of workstations, including those that are not currently rented, a workstation currently generates just under $390 in monthly revenue.

Unfortunately, there are no figures for individual cities, so it is difficult to make an industry comparison with absolute prices. Coworking space operators can compare revenues with their own. It is reasonable to assume that the reported figures in many cities are not below the industry average. Combined with recent occupancy rates of over 70%, this suggests a business model that the market has largely accepted successfully.

Most importantly, the market corrections that still lie ahead for much of the traditional office market have already been completed, so no further major downward revisions are expected on the income side unless geopolitical events drag the economy down further.

The insolvency of WeWork is still in its infancy

The figures evaluated in the article only indicate what could happen and what would be the minimum necessary for a successful restructuring. However, company reports do not contain all the figures needed for a detailed analysis. Nor can this be done in just a few lines.

Aside from day-to-day operations, WeWork will need the bankruptcy court's approval for all future structural steps. It will be easier for WeWork to get that if its creditors agree. But even without creditor approval, WeWork can reposition itself during bankruptcy.

So WeWork is at least setting the direction. And that direction can also be gleaned from previous announcements. Since 2019, WeWork has said it wants to divest itself of "underperforming" and "unfit" locations, a statement repeated several times in subsequent reports.

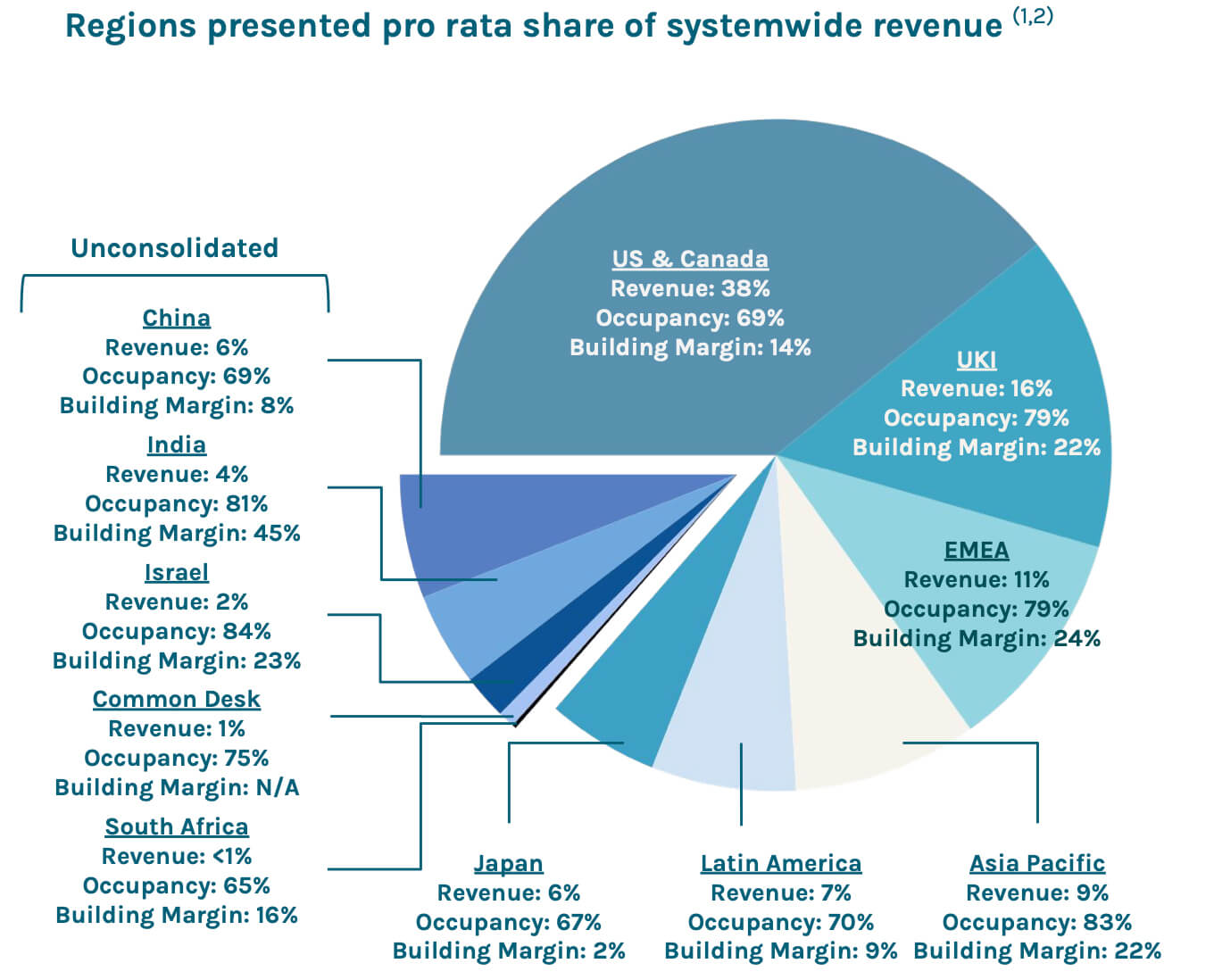

In its investor presentations, WeWork also reported a "building margin," which indicates how well WeWork values its locations, at least in individual markets:

These two statements suggest that location closures are most likely to occur in the company's home market of the United States, at least if landlords do not offer significantly better terms.

WeWork locations in Japan, China, and Latin America would also be on the chopping block more often, as they underperform on average. Unless they are kept for prestige and networking reasons, and WeWork can or wants to continue to operate as a global company in its model.

With "building margins" above 20%, WeWork spaces in Europe, Asia Pacific, and India are less likely to be impacted. However, the above chart does not show the margins of the individual locations that may be at risk.

There is also the possibility that WeWork could sell overperforming locations or entire markets. In the current situation, however, doing so would only make sense if the proceeds did not go to creditors and WeWork could retain such revenue for its own liquidity.

::: More updates on potential location closures :::

WeWork has issued an announcement to its members about what to expect during the Chapter 11 reorganization. It also lists some differences between affected locations in the US & Canada and those regions that are not (yet) affected.

A list of locations where WeWork has requested to terminate their leases